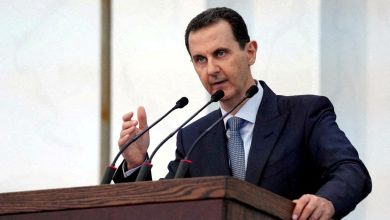

The Assad regime imposes new taxes on real estate transactions

In a communiqué, the Assad regime imposed a new tax on some real estate transactions that are regulated in its courts.

The decision stipulated that non-removal agencies, gift contracts, cases of transfer of ownership by inheritance, or any type of transfer of ownership, are considered as sale, and a tax must be paid on them.

According to the report, the decision has been in effect since the current month of May, and according to which registration service fees are calculated based on the popular value of the property.

The Central Bank of the Assad regime had issued a decision to compel people who are going to buy a property or vehicle to open a bank account, and put a sum of money in Syrian pounds in it, to pay the price of what they bought.

This operation aims to compel residents of the Assad regime-controlled areas to buy and sell in Syrian pounds only, and to collect taxes from them.

In order to avoid this process or buying and selling in Syrian pounds and the consequent large losses, especially with the large fluctuations in its exchange rate, the people resorted to registering sales contracts as gifts rather than sales in order to avoid paying tax and to preserve their savings.

Since the beginning of this year, the Syrian pound has witnessed a sharp decline in its exchange value against the dollar, as the dollar exchange rate reached the 5,000-pound barrier, which prompted residents in the Assad regime-controlled areas to convert their savings into gold, especially with the criminalization of saving or dealing in foreign exchange.